The Helium Network recently migrated to the Solana Ecosystem, a strategic move aimed at building a “network of networks.” This network already encompasses LoRaWAN (also known as “IoT”) and CBRS (also known as “MOBILE”), with plans to incorporate more networks in the future. However, this migration has resulted in some changes, one of the most significant being the governance structure.

Before the migration, Helium Vote was utilized for decision-making, with users required to “burn” Data Credits to participate. After the migration, Solana Governance Realms are employed – an existing infrastructure used in numerous other projects. This shift presents an opportunity for Helium stakeholders to learn about staking, the economics of staking, and to engage in the decision-making process.

In this blog post, we will delve into the Helium Network’s staking system and the economics of staking. Furthermore, I will provide a Stakers Analysis, examining the data and offering insights into how staking influences the network’s economics and governance.

Introduction

I already shared an introduction to LoRaWAN and an introduction to Helium.

I acquired my first coins around 10 years ago, back in 2014. I received several Bitcoins from a side-project, each worth about $400 at the time. No one could have predicted that Bitcoin’s price would eventually exceed all expectations. The concept of “staking” was unimaginable back then.

Despite being an early adopter of cryptocurrencies, I had never engaged in staking. The Solana migration was a significant learning experience for me, as it introduced numerous new concepts and ideas. In this blog post, I will summarize some of these key concepts.

Staking

Staking is the process of holding and locking a specific amount of cryptocurrency in a wallet to support a blockchain network’s operations. By participating in staking, individuals can take part in the consensus mechanism of the blockchain and earn rewards for their contributions.

When staking your cryptocurrency, you essentially make it available for use in validating transactions and securing the network. In exchange, you may receive rewards in the form of additional cryptocurrency, generated by the network as an incentive for stakers.

subDAO

A subDAO is a sub-decentralized autonomous organization that exists within a larger decentralized network, such as the Helium. It allows a group of token holders to come together and pool their resources to achieve a common goal.

In the case of Helium, subDAOs can be created to support different aspects of the network, such as IOT (LoRaWAN) or MOBILE (5G/CBRS) Users can delegate their veHNT tokens to a subDAO and earn rewards based on the amount of tokens delegated. The subDAO then uses these tokens to fund projects that benefit the network, and the rewards earned by users are a way of incentivizing participation and contribution to the subDAO’s efforts.

veHNT

veHNT stands for “voting-escrowed HNT,” and it is a way for Helium token holders to participate in network governance and decision-making. When HNT is locked into the voting escrow, it is converted into veHNT, which can be used to vote on network proposals and decisions.

It incentivizes long-term commitment and aligns stakeholders’ interests with the network’s success. The amount of veHNT received depends on the lock-up period, with longer periods resulting in a higher veHNT multiplier. Once the lock-up period ends, the HNT is released back to the user’s wallet.

Although veHNT is a token, it can not be sold or transferred.

Delegation

Delegation means giving your veHNT tokens to a subDAO (e.g. IOT or MOBILE) to earn rewards from token emissions. The longer you delegate, the more rewards you can earn. You can manage your veTokens through Realms in the Helium Wallet App. The amount of rewards you receive depends on the amount of veHNT delegated to the subDAO you choose, and this can increase or decrease depending on various factors, such as the amount of veHNT delegated by others, the number of hotspots online, and the amount of network data transferred.

Rewards

Besides earning rewards through Proof-Of-Coverage, it is now possible to earn rewards by holding and locking up veHNT tokens for a specified period, or by delegating their veHNT to a subDAO to support projects and initiatives.

The amount of rewards earned depends on various factors, such as the amount of veHNT held or delegated, the length of the lock-up period, and the success of the subDAO’s projects. Rewards can be in the form of additional cryptocurrency generated by the network, which can then be used for various purposes, such as trading or staking to earn even more rewards.

Voting Power

Voting power refers to the influence that your vote has in making decisions for a DAO (Decentralized Autonomous Organization) or subDAO. In the Helium Network, your voting power is determined by the amount of veHNT you hold. The more veHNT you have, the greater your voting power.

To increase your voting power, you can stake more HNT or extend the lock-up period for your veHNT tokens.

Landrush

Landrush is a bonus program offered by Helium Network for the first 10 days following the Solana migration. During this period, HNT holders are eligible to stake their tokens for a bonus of 3x the lock amount. However, if a landrush stake is moved or split after the first 10 days, the bonus is forfeited. At time of publishing this blogpost, the landrush period already ended.

Locking Type: Constant and Degrading/Cliff

There are two types of locking mechanisms. “Constant” and “Degrading/Cliff”. The locking types are relevant for the Stakers Analysis. Understanding these will help understand the distribution of positions.

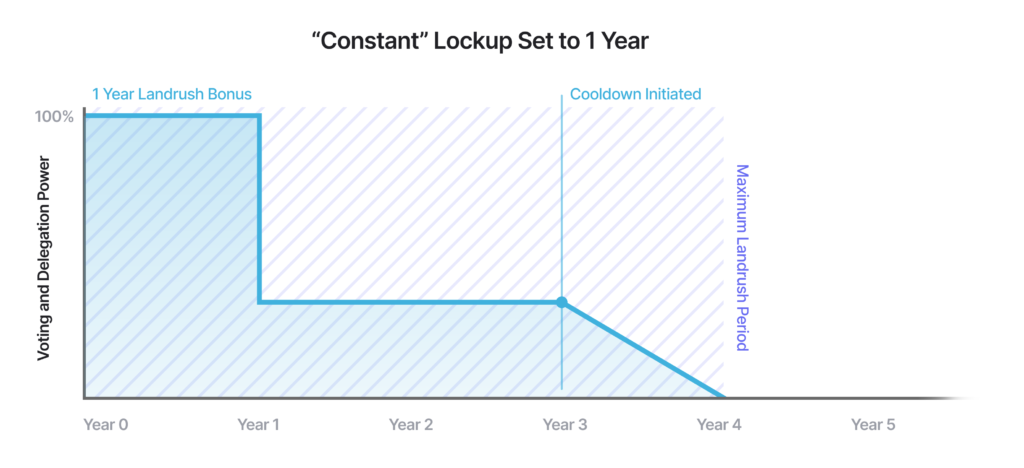

Constant

When you choose the “Constant” locking type for staking in the Helium Network, you are locking your tokens indefinitely. You can start the unlock process at any time, but the process lasts for the initial lockup duration that you chose. During the lockup period, your voting power stays constant, meaning that your vote has the same weight throughout the lockup period.

However, once you start the unlock process, your voting power will decline linearly until the tokens are released. For example, if you lock 10,000 tokens with a lockup duration of one year and start the unlocking process after three years, your voting power will gradually decrease over the course of the fourth year until you can finally withdraw the tokens.

Overall, the “Constant” locking type is a way to lock your tokens for an extended period and maintain a constant voting power during that period. However, it’s important to consider the implications of the declining voting power once the unlock process begins.

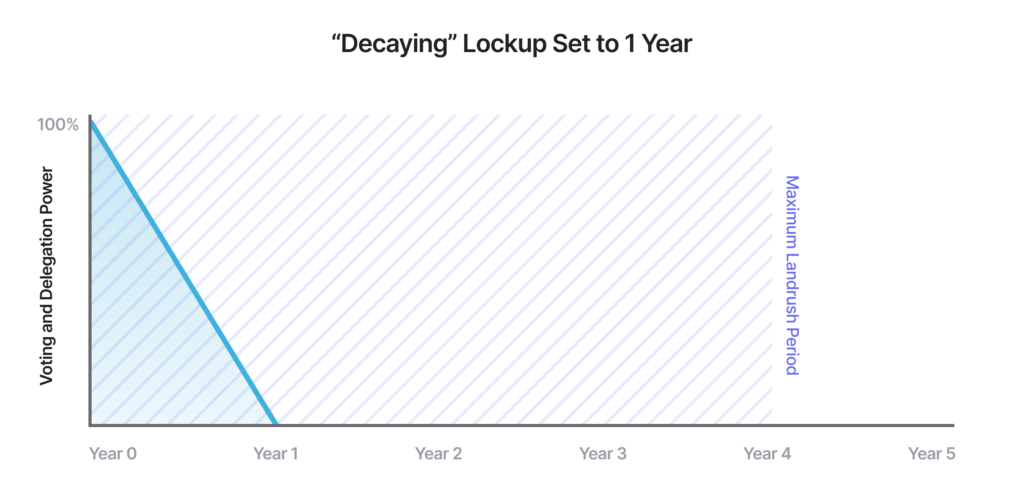

Degrading/Cliff

When this locking type was initially introduced, the term “Cliff” was used. This term was ambiguous so it was renamed to “Degrading”.

When you choose the “Degrading” locking type for staking in the Helium Network, you lock your tokens for a fixed duration and release them in full at the end of the lockup period. During the lockup period, your voting power declines linearly until the tokens are released. This means that your vote weight gradually decreases over the course of the lockup period.

Effectively, this means that the cooldown period starts at the moment of staking, and you will need to close the position to return the staked HNT to your wallet after the cooldown period has ended.

For example, if you lock 10,000 tokens with a lockup duration of one year, they will be unavailable for the next year, during which time your voting power will decline linearly. After one year, the tokens will be released, and you can withdraw them to your wallet.

Overall, the “Degrading” locking type is a way to stake your tokens for a fixed duration and gradually decrease your voting power over the lockup period. It’s important to consider the implications of the declining voting power when choosing this type of locking.

Stakers Analysis

Now, let’s dive into the exciting part of this post. The landrush period has just ended, which means the 3x multiplier no longer applies. During the landrush, participants received three times more veHNT for the same amount of locked HNT and locking period, resulting in increased voting power and rewards. Naturally, this led to more stakers joining the network, leading to a lower share of veHNT for each individual staker.

Blockchain data offers a complete list of delegated positions, indicating veHNT delegated to a subDAO. With this data, we can derive some fascinating insights

The source of this analysis is a GitHub project that connects with a Solana Endpoint and extracts the data in a way that makes it suitable for this type of analysis.

IOT vs. MOBILE

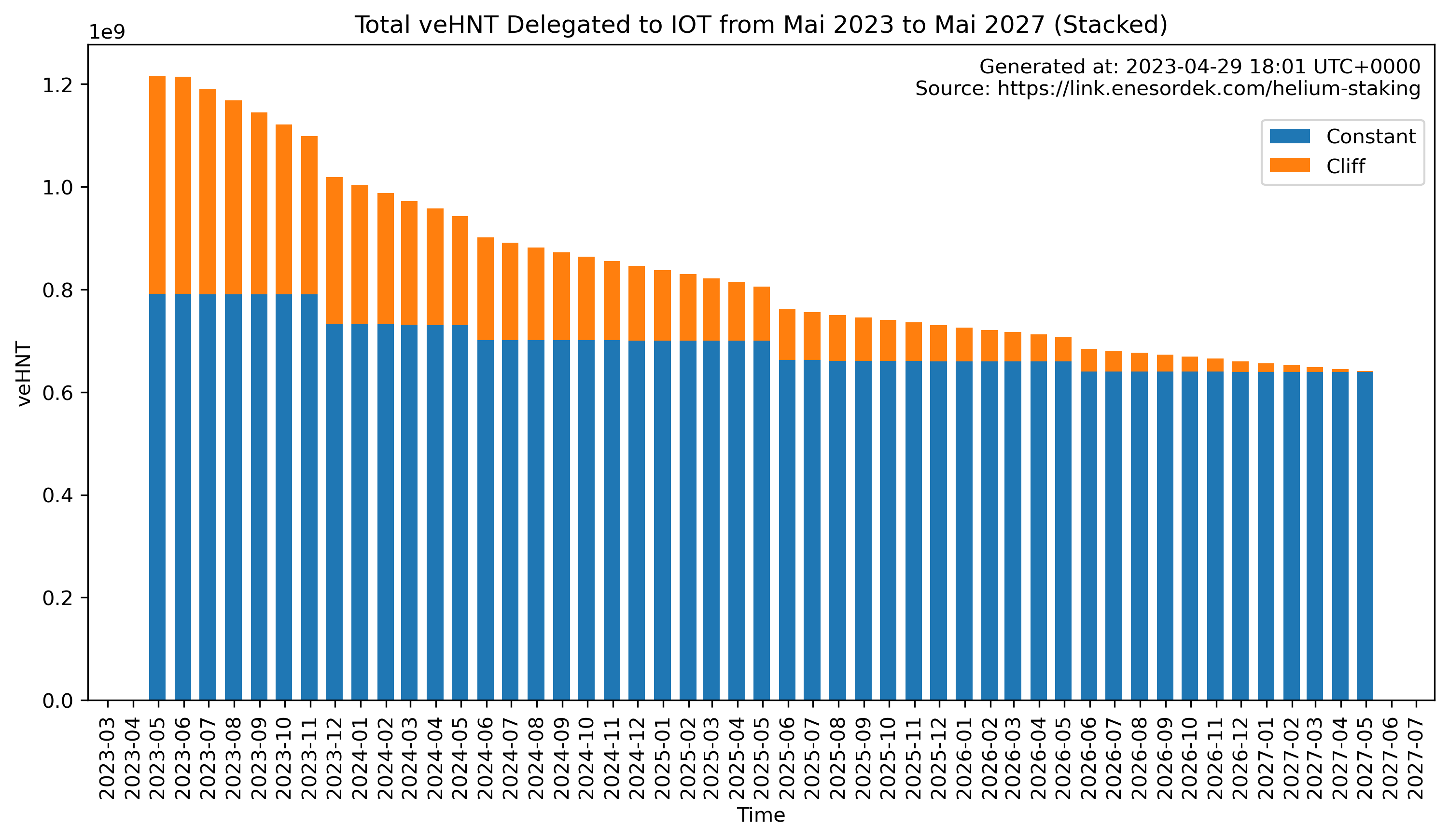

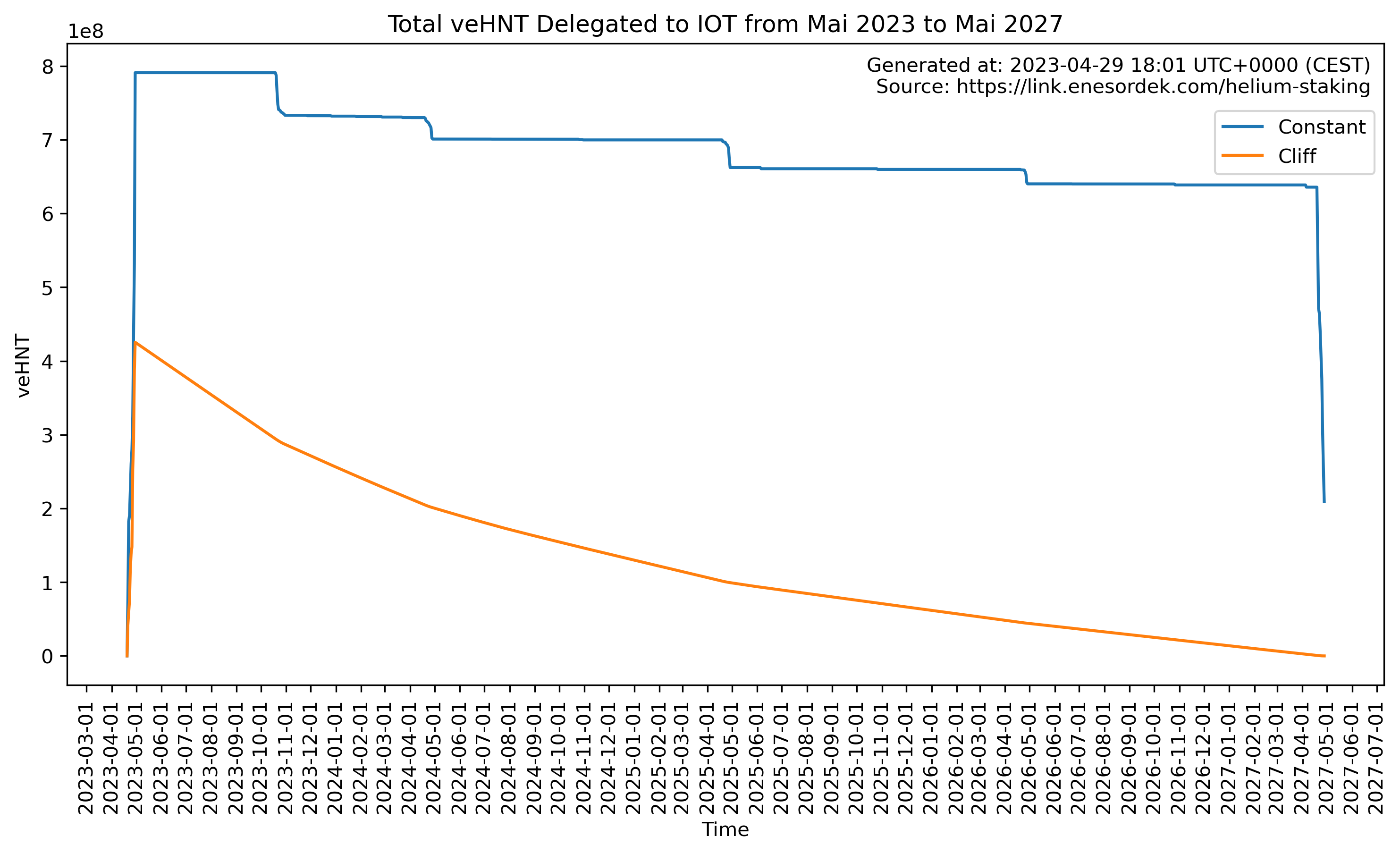

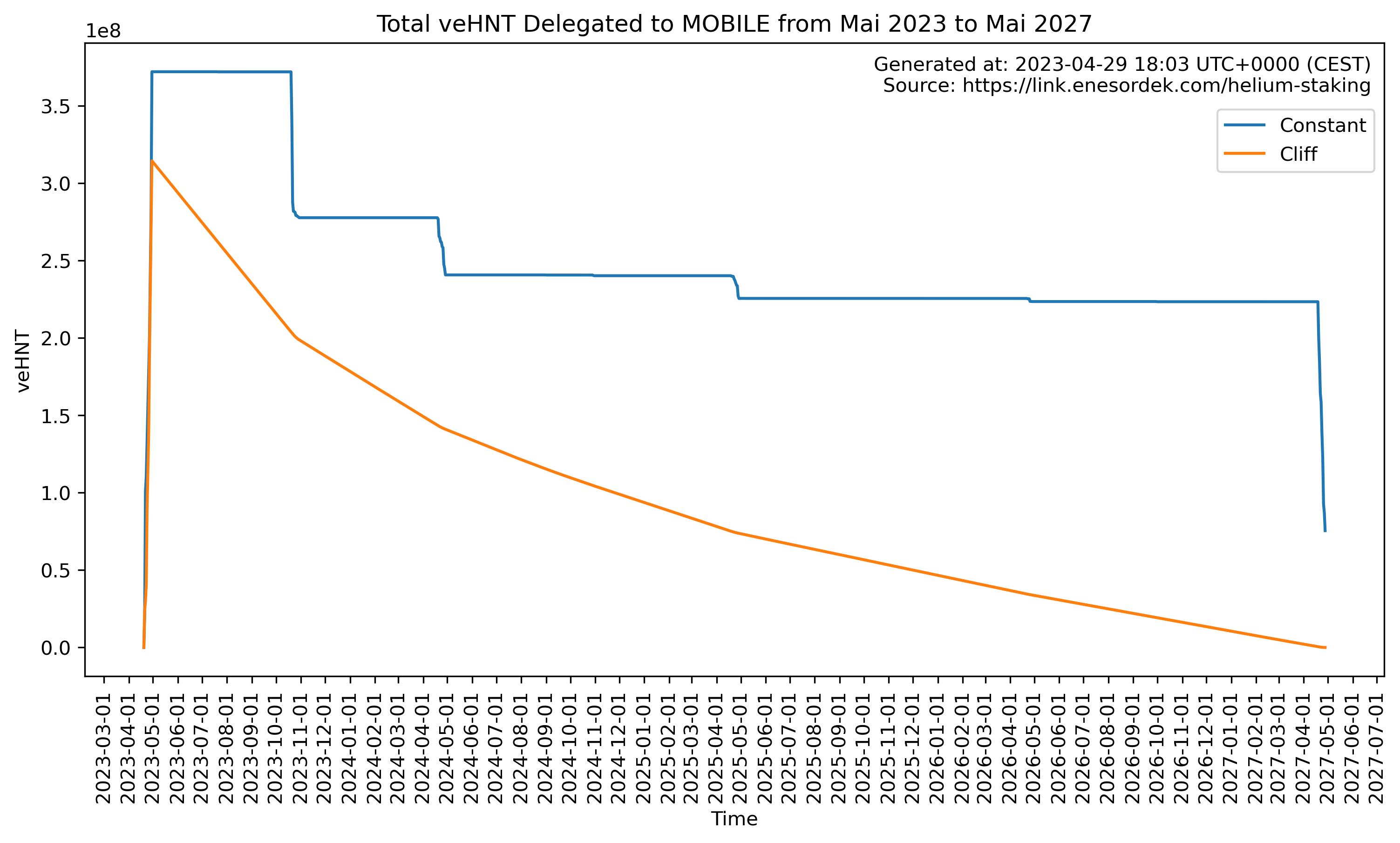

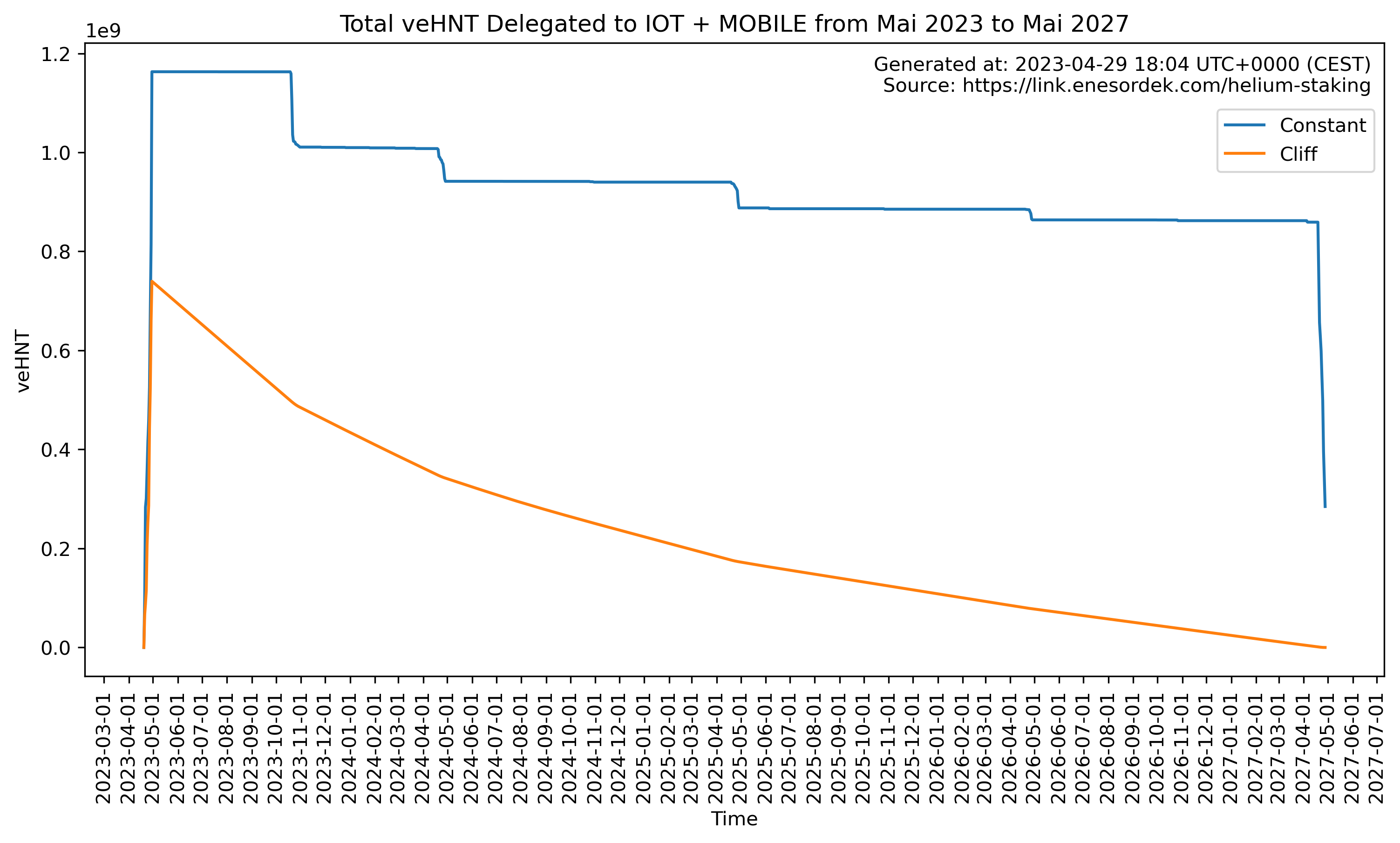

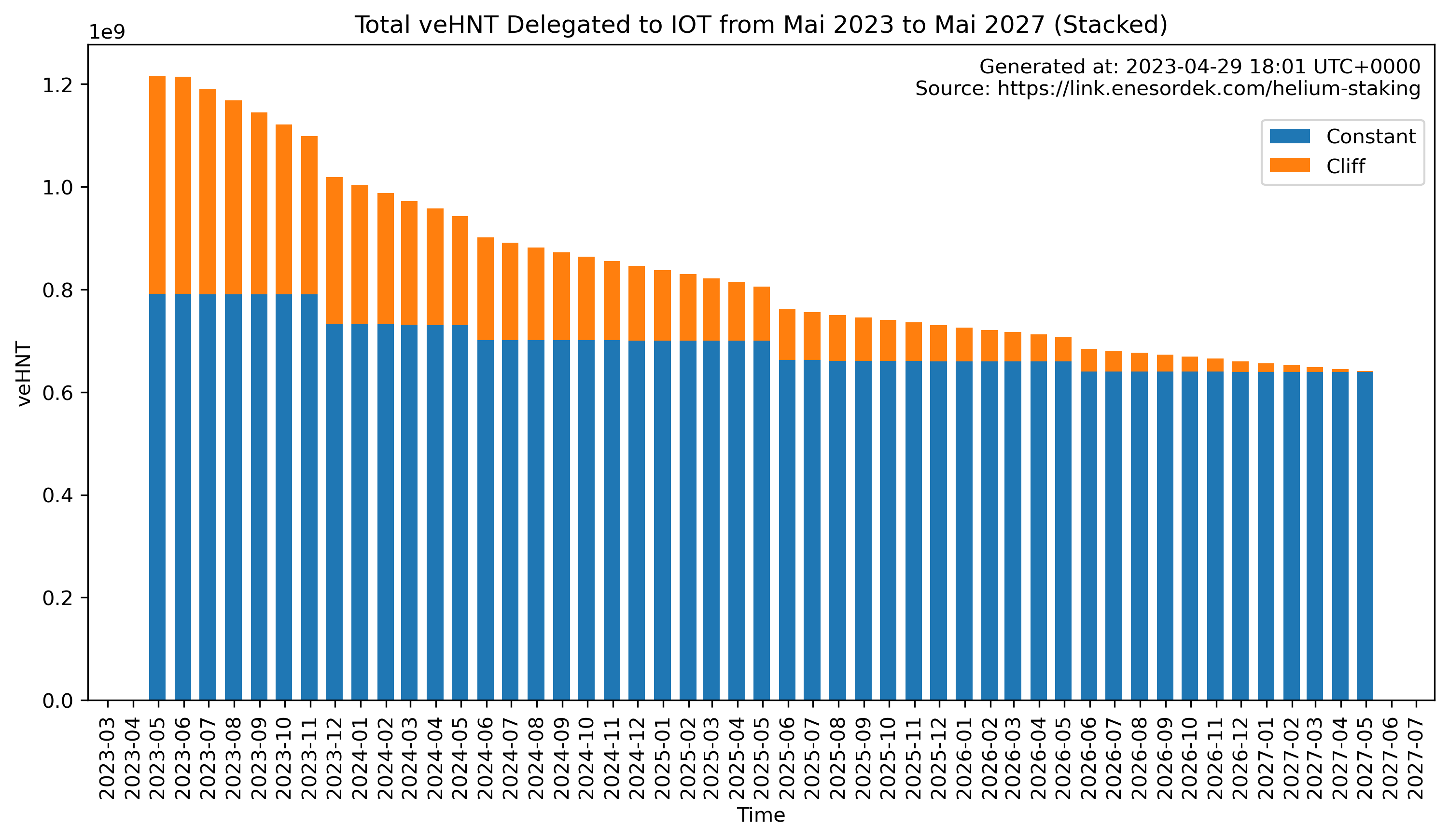

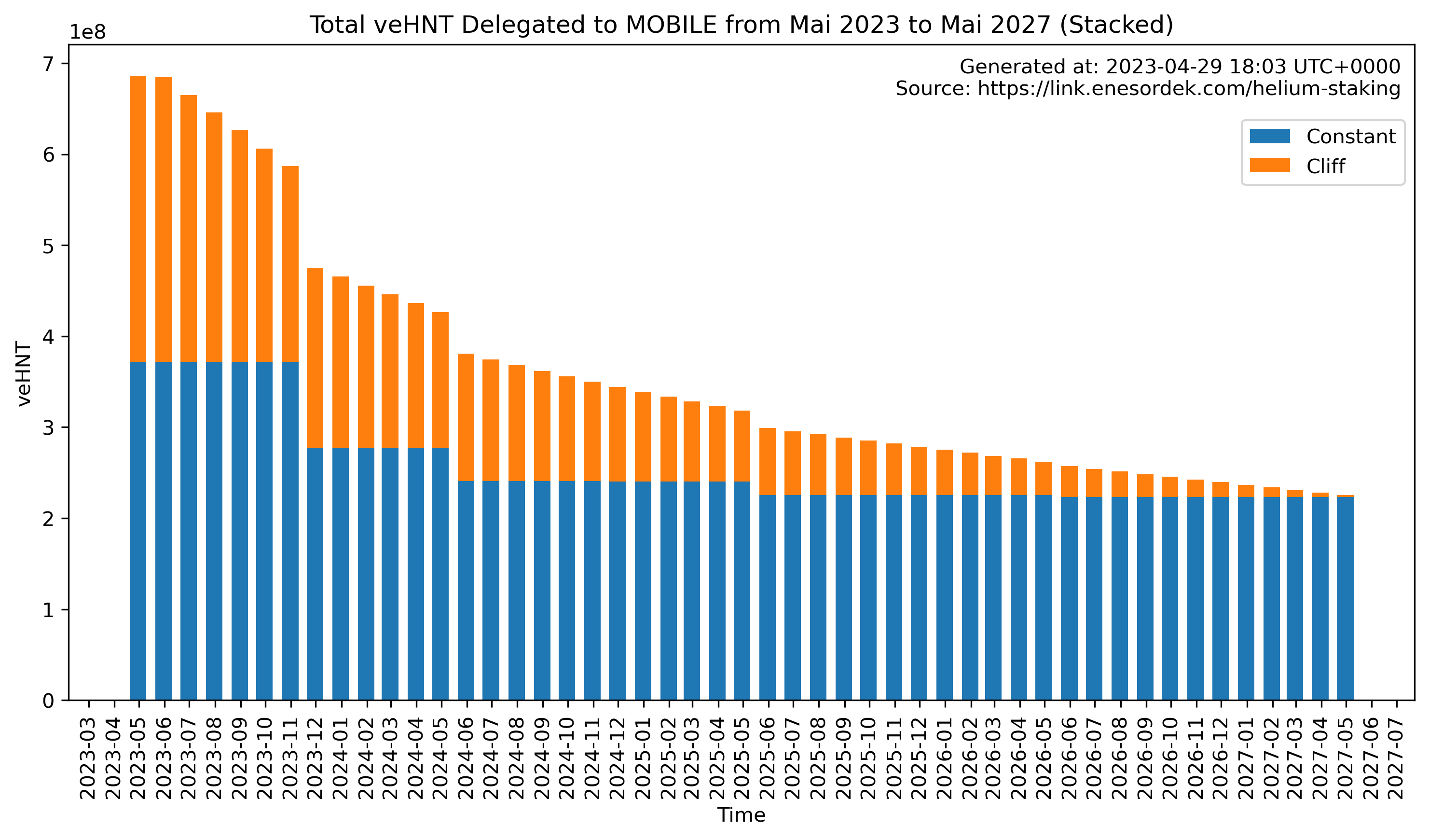

Upon examining the current snapshot of delegations, we can discern the outlook for different subDAOs. By comparing the commitment to MOBILE and IoT, we can analyze the ratios of veHNT for various locking types.

The first graph displays the total veHNT of IoT, while the second showcases that of MOBILE, facilitating a straightforward comparison.

The ratio of MOBILE is lower, causing the “Cliff” category to have a larger proportion in the overall veHNT. “Cliff” is likely perceived as less risky here, as MOBILE is a relatively new subDAO and heavily regulated outside the US. In conclusion, the ratio of veHNT in Constant and Cliff is higher for IoT than for MOBILE.

Number and Size of Positions per Locking Type

Next, let’s examine the number of positions, with one position representing a delegation, regardless of the veHNT value of that position.

In this analysis, the total number of delegated veHNT is larger for “Constant” than for “Cliff”.

When considering the number of positions, we observe a different pattern. Many positions fall under the “Cliff” category. Combined with the previous plot, we can infer that smaller veHNT positions are more frequently locked with “Cliff”. I speculate that these smaller positions were primarily used for testing purposes. The more substantial, “real” positions tend to be long-term and utilize the “Constant” locking type, demonstrating long-term commitment to the subDAOs.

Conclusion: Smaller positions more often use short-term locks and the “Cliff” locking type.

Share of veHNT

The share of veHNT is crucial in estimating rewards and voting power. In the Cliff locking type, the number of veHNT decreases over time, whereas, in Constant, it remains the same throughout the lockup period.

The following graphs display the stacked amount of veHNT, revealing noticeable differences between IoT and MOBILE. For MOBILE, every veHNT locked in Constant corresponds to three veHNT locked in Cliff, resulting in a 1:3 ratio. For IoT, this ratio is 1:2. This could indicate that stakers are more confident in IoT than in MOBILE.

Conclusion: Assuming that “Constant” is primarily used for long-term commitment, it appears that stakers are more committed to IoT than MOBILE.

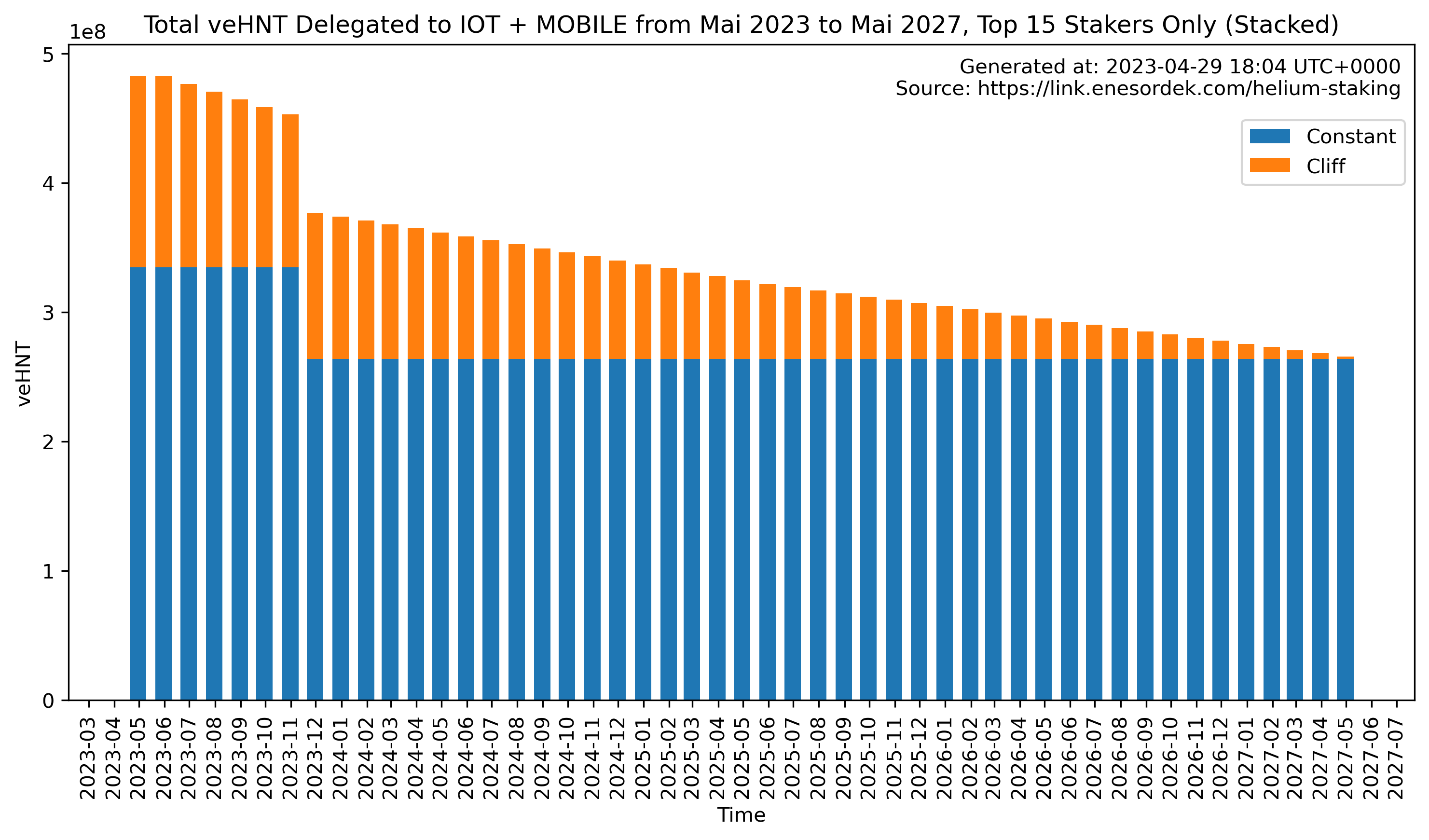

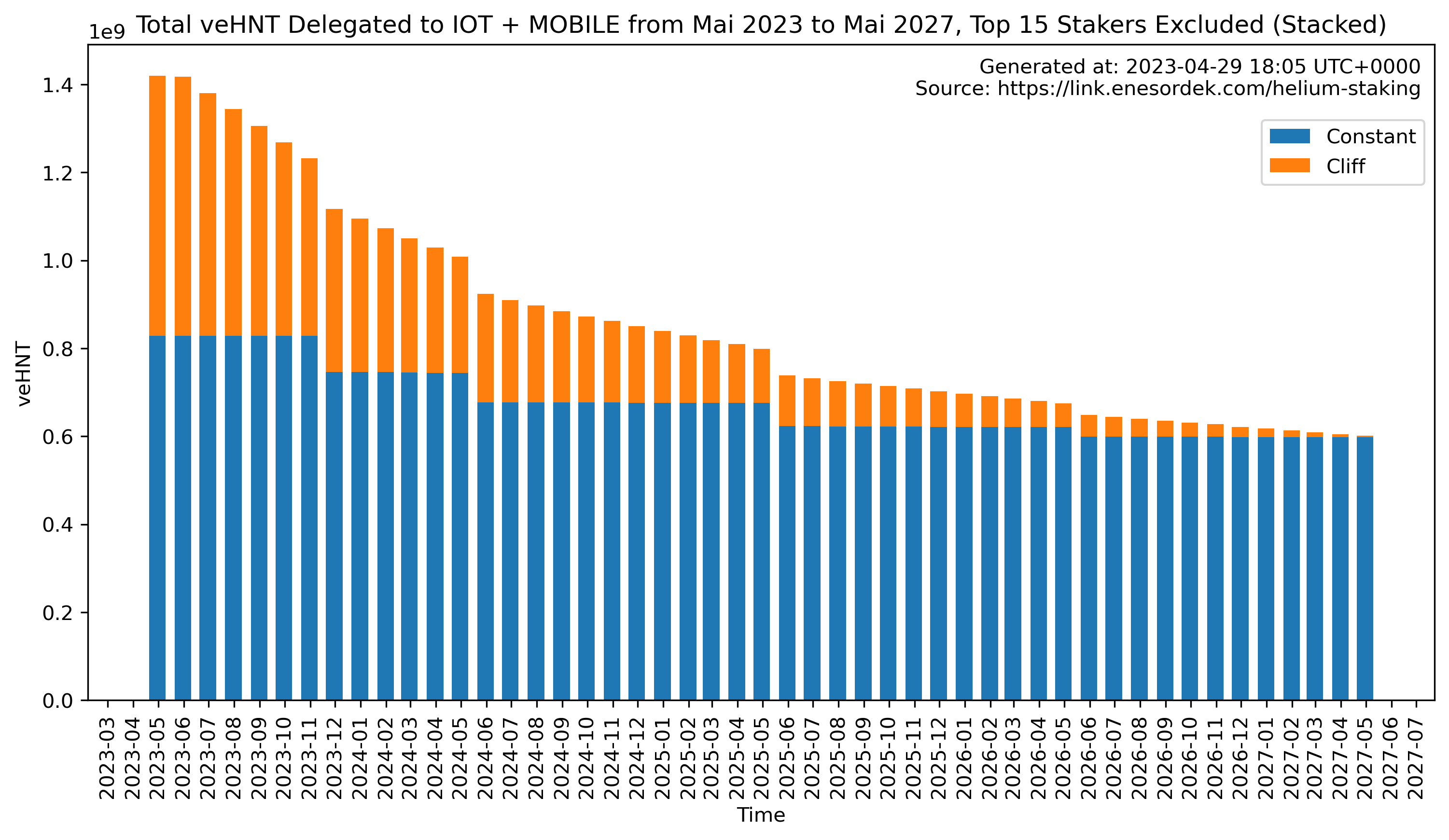

Top 15 Only vs. Top 15 Excluded

In this analysis, I classify the Top 15 positions as “whales.” When a whale decides to exit an investment, it often spells trouble for investors with smaller position sizes. Thus, examining the top positions is crucial for understanding whether whales are committed for the long-term or short-term. Long-term commitment is generally better for all investors and the project, while short-term commitment can lead to profit squeezes, which typically have negative consequences for the project.

The following graph appears quite promising. According to these plots, whales hold more long-term positions than non-whales.

Conclusion: Whales are more inclined toward long-term commitment (“Cliff”) compared to non-whales.

Summary

Stakers can change their position and delegate their veHNT to another subDAO at any time. However, the locking type remains constant, reflecting the sentiment within the community for specific subDAOs. In a few months, I plan to conduct another analysis to examine how positions have shifted, the amount of rewards claimed, and the quantity of HNT set to be unlocked.

Download all the plots and more here. Thank you for lthiery for providing the GitHub project to download the realtime data.

Follow me on Twitter to get notified about new content. Until next time!